If you’ve been around here a little while, you’ll know by now how I feel about investing.

When I started learning about investing, the power of compound interest and how much difference to your future it can make, it was a no brainer! But what put me off for so long, as I know it does for others, was not knowing how it all works. The world of finance and investing is packed to the brim full of jargon, ‘finance bros’ (coined by @girlsthatinvest), complicated looking graphs, news headlines about stock market crashes – right?

But the first things to know are that it’s ok to not know it all!

You can start investing without being an expert investor. And there are so many reasons why we as vets should be thinking about investing – let’s walk through them.

Increase your chances of retiring early

I don’t know about you but grinding until the age of 65 plus on an extremely meagre pension (I urge everyone to have a go at a pension calculator tool to see how little they’re due to live off when they retire), is something I don’t aspire towards.

And don’t get me wrong, some people absolutely love what they do and live for it. But that is amazingly privileged. For most, work is a means to an end; and that end is enjoying life outside of work.

So why not try and retire early and enjoy that life outside more! And if you don’t want to fully retire early, then you have the option to work part-time or maybe stop on-call.

I’ve talked about FIRE before – you can check out more details here. FIRE stands for Financial Independence Retire Early.

Unless you’re putting away a serious amount of spare cash, and I know that most vet salaries and the current cost of living don’t make that very possible, the only way you’re going to grow your wealth enough to retire early is by investing your savings.

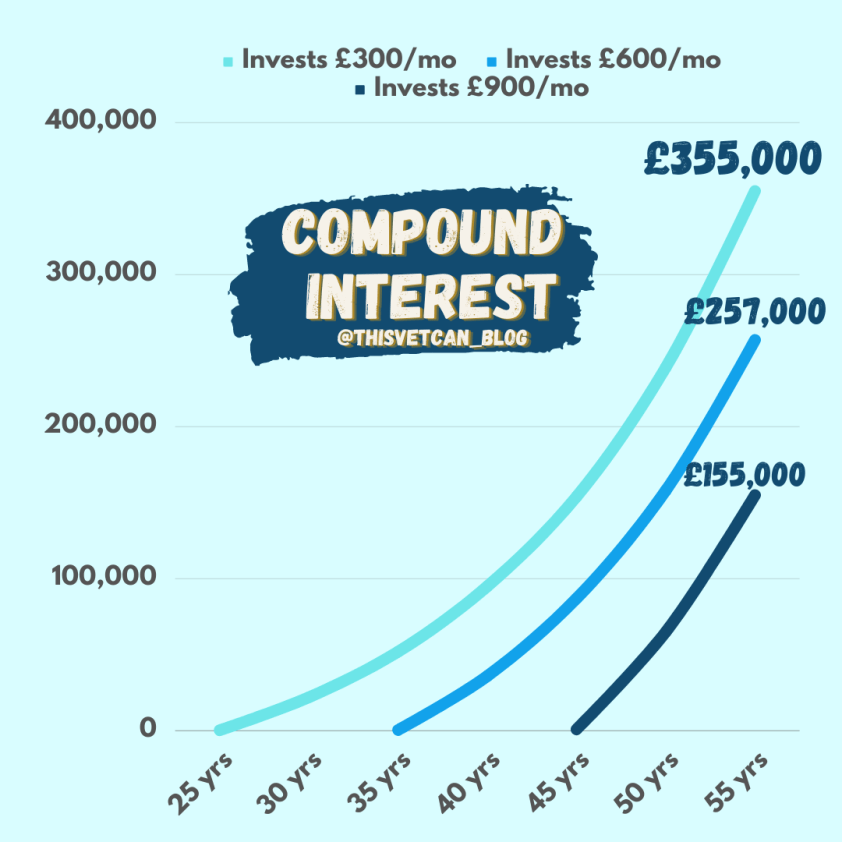

Because by investing your money, a little thing called compound interest happens. The sooner you start investing money, the longer it has to grow. And thanks to compound interest, if you start investing even a small amount early on, your money has time to snowball and snowball compared to if you start investing much more later on! See my handy graph below to illustrate this better than I can write it:

On the flip side, if you started putting away £300 in a cash account from the age of 25, with a 1.5% interest for 30 years instead… that only comes out at £108,300. Yikes.

Receive passive income from investments

You can use investments to form a passive income stream as well as just wealth building. Everyone likes the sound of earning money while you sleep don’t they.

Some stocks and shares can be selected for high dividend yields. As a shareholder, you will receive dividends from the companies you’ve invested in (this works for funds too), when they earn a profit. This profit is divided up and distributed to shareholders regularly through the year.

It is worth noting that if you’re receiving high enough dividend yields then this qualifies to be taxed under normal income tax rates.

You can also hack the system, and if you can do without the dividend payments coming into your account for a while to start with, reinvesting back your dividends for the first few years can sometimes almost double your passive income generation. That said, investing always comes with risk, so you also have a chance of losing your extra investments.

Why is a passive income stream so useful for vets and RVNs in particular? Firstly, the profession is a dangerous one. There are plenty of opportunities to end up being off work sick for long periods – a nasty kick here, a cow crush incident there… the equine veterinarian has one of the highest risk occupations of all civilian jobs, and smallies and farm aren’t far behind.

Hopefully you have income protection insurance so if you have to take a significant amount of time off work, then you should receive a monthly income from them. But remember, you’ll only receive a proportion of your usual salary so having some extra passive income to top this up can be extremely helpful!

Not to mention the sorry state of vets salaries and even more so RVN salaries, passive income can be a really big support when you’re trying to save up for a house purchase for example.

Beat inflation by investing savings

As we saw in 2022, inflation can be a terrible thing that eats away at our salaries and cash savings. If you keep all your savings as cash – either hidden under the bed (not advised!) or in a cash bank account – then your real-term value decreases year on year and you end up with much less purchasing power than you did originally.

The only way to beat inflation (or at least keep up with it), is to invest your money.

Obviously this comes with the disclaimer that you invest money at your own risk – and there are some scenarios where it is best to keep your money in an accessible cash account instead, like your emergency fund, or your house deposit savings if you’re close to purchasing – you don’t want the market to suddenly drop when you need this money ASAP.

That being said, when we’re looking at long-term savings like a retirement fund, this is one hundred percent the type of savings we need to invest to beat inflation over 20, 30, 40 years.

For example if you look at the S&P 500, a really commonly invested in index, which tracks the performance of the 500 largest companies listed on stock exchanges in the United States. The average annual return rate over the last 30 years is 10.7%. In the UK, the inflation rate averaged 2.70% from 1989 until 2022.

The Bottom Line

So many good reasons to invest but I know that it can seem really intimidating to a lot of people. Thankfully there are a tonne of resources out there that can teach people about it. If people are your thing, do find a friendly financial advisor to see what the best thing for you would be and how to go about it.

But also check out apps that teach you like Your Juno, platforms and communities like Female Invest, and books such as Her First 100K by Tori Dunlap, and Girls That Invest by Simran Kaur.

Sorry they’re all a bit along the feminist/female bias but I’m all for empowering women about finances.

I am no financial advisor or finance professional so I need to say that you do invest your money at your own risk. Please seek advice from an independent financial advisor 🙂