We’ve all heard it before, time equals money and money equals time. But when money means wealth, and wealth equals time, we can expand that a little and end up with – wealth equals time freedom. And time freedom means the ability to choose how you live, work and play!

THAT is why I started to get interested in personal finance. If you’re like me, the daily grind for another 40 years in order to pay the bills does not sound appealing. Even if you get lucky and find a job that you love, wouldn’t you rather do it because you wanted to and chose to, rather than needed to survive?

I’m certainly no expert on personal finance but I do admit I’m kind of addicted to the topic. Mainly because it feels empowering to be able to make changes that will hopefully have huge effects for me down the line.

It’s also hard to get away from the feeling that people in their 20s and 30s these days have got a much bigger mountain to climb (economically metaphorically speaking) than our parents did. But this does not mean that we can’t put into place the best practice for accumulating wealth and giving ourselves the best options from what we’ve got!

So, without further ado, here are 3 insanely good reasons to start taking an interest in personal finance!

#1

Your workplace pension alone will not be that much!

Sorry to burst your bubble – and don’t get me wrong pensions are an awesome place to save money – but have you ever looked at how much you might have in there by the age of 65?

For absolute transparency, I recently increased my contribution from 5% to 9% so make average monthly payments of just over £300. On the online Scottish Widows calculator, they estimate that my total pension pot at the age of 65 would be approximately £276,000 pre tax if I continued on the same contribution. So the approximate annual income I’d get would be £11,500 pre tax – that’s just over £950/month!

Obviously I aim to increase my salary over time and will therefore continue to add more and more into my pension. However, my predicted total does not allow for a lot of living! I envisage retirement as a chance to travel, treat friends and family, enjoy the freedom to do what you want…

I really urge you to have a look at your own and work out what you might end up with. Ask yourself if you can increase your contribution, and then ask what more do I need to save in order to have the retirement that I really want?

Side note: all you ladies out there need to be extra critical of your pension as we are more likely to take time off work to have children in the future AND are more likely to outlive men. Therefore (and unfortunately it’s true) we are statistically more likely to have less in our pension pot but will need to stretch it for even longer!

#2

Use the power of compound interest and start investing early!

An even more insanely good reason to get interested in personal finance is so that you can learn and start to invest! See my previous blog on a step-by-step guide to making your first investment online here.

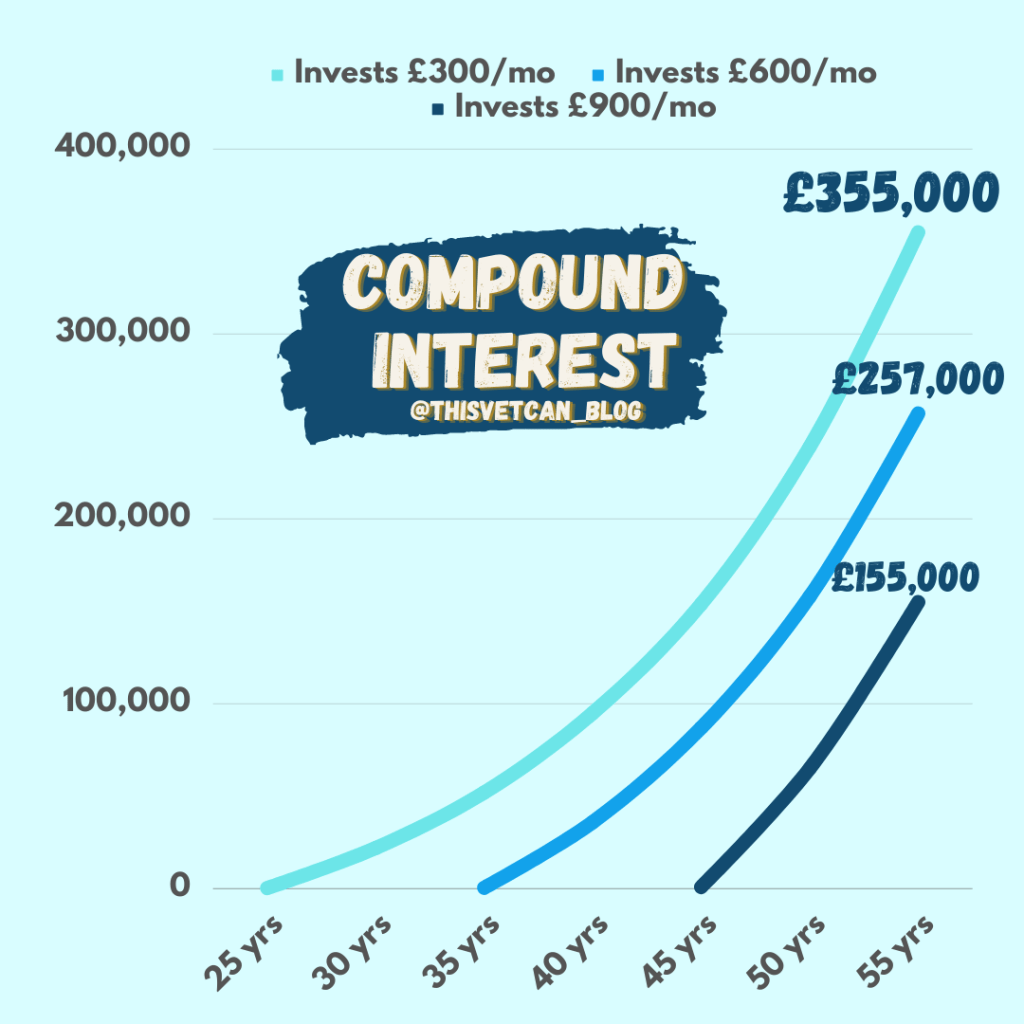

And why should you start? Because the sooner you invest money, the longer it has to grow. And thanks to compound interest, if you start investing even a small amount early on (often only £50 minimum per month!), the money has time to snowball and snowball compared to if you start investing much more later on! See my handy graph below to illustrate this better than I can write it:

So the person who started investing only £300/month at the age of 25 years ends up with more than the people who invest a lot later, despite them investing double or triple the amount per month!

Surely you can’t let this opportunity slide! See my instagram for posts on finance accounts to follow which regularly put on free investing masterclasses for beginners! (Finansa and Female Invest are my favourite…)

#3

Getting real with your finances means you can actually think about them less

I used to hear people talk about ‘financial security’ all the time without really truly realising what they meant. But now I realise, by having an emergency fund (more info on this here!), having personal income protection insurance, having automatic payments into my savings accounts, and investing my money for long-term goals… I feel secure!

If my car broke down tomorrow – thanks emergency fund!

If I broke my wrist and couldn’t work tomorrow – thanks personal income protection!

If I got a bit heavy handed with my internet shopping one month – automatic payments to my savings accounts have already gone as soon as I got my pay-check, so I don’t ever self-sabotage!

You don’t need the day-to-day stress of what financial burden is just around the corner and the ‘will I ever be able to save up for blah?’ added to your already extremely busy life. No one out there deserves that.

Conclusion

This is not a blog where I just boast about my financial prowess to make myself feel great, I just wanted to be real and basically share my passion for financial awareness. Taking the opportunity to make a difference for your future self and secure that time freedom is, in my opinion, one of the best things you can do as a young professional!

If you enjoyed this, please like, share and comment! Or if you want to let me know personally, DM me on the @ThisVetCan_Blog Instagram!

** Disclaimer – this is information, not advice. Please consult a financial advisor for personal advice.