Want to make your money work for you but don’t know where to start? Stock market seems kinda scary and you have no idea how to choose what to buy and how much to buy? Feel like you need to save up a significant amount of money before you even start? No idea how to actually go through the physical process of investing online?

I could say yes to all of these this time last year!

And I really have to reiterate – I am no financial advisor or finance professional so I need to say that you do invest your money at your own risk; and this blog is only a guidance on what I did to start my investment journey! Only invest if you want to, it’s the right thing for you and know that your capital is at risk of loss.

First things first, let’s address a few of the queries and misconceptions above. To start with, you do not need any huge amount of money to start investing. You should absolutely make sure you have an emergency fund in place before you start investing your savings. Once you have 4-6 months’s worth of necessary living expenses in an accessible savings account, anything extra you save can now be invested.

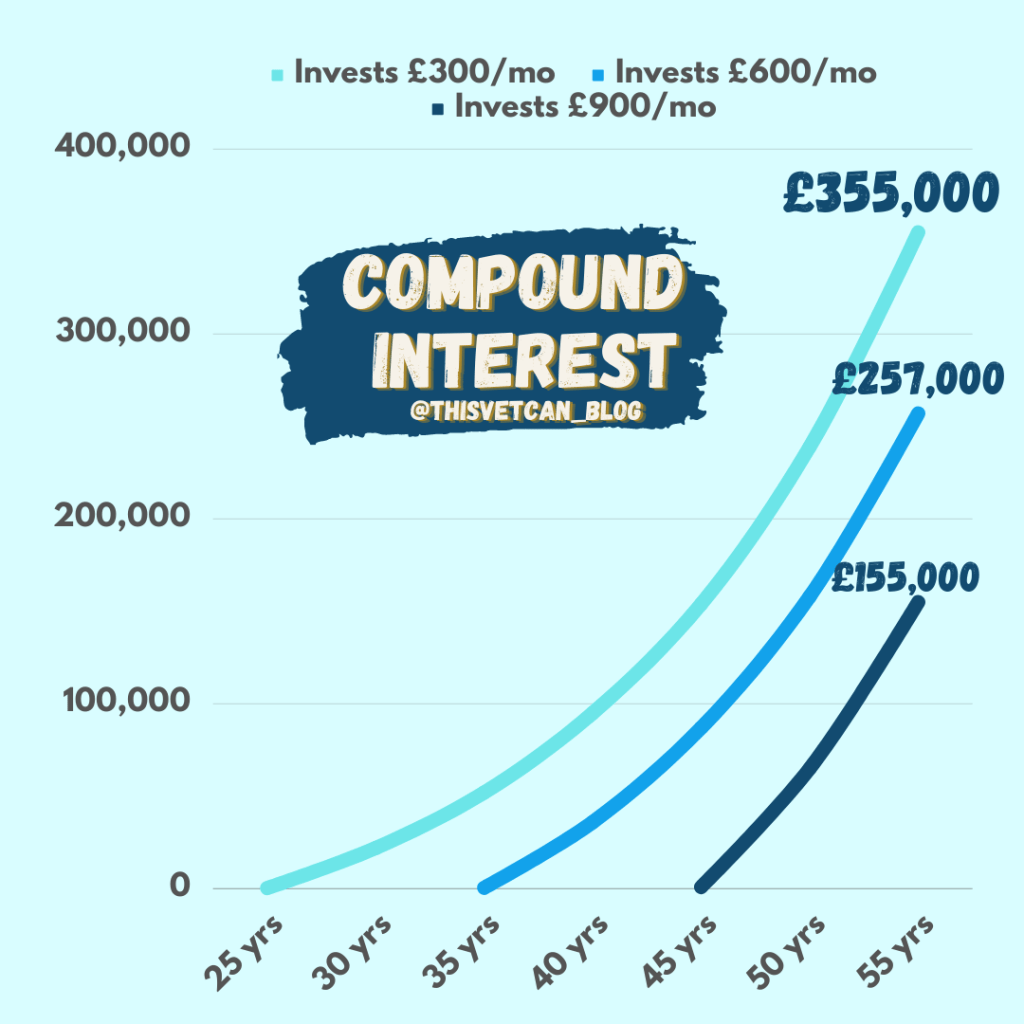

Most trading platforms/online brokers let you invest with as little as £50 per month and starting sooner with less money, always beats waiting until you have more money due to our little friend compound interest.

The other benefit of investing little and often is to employ ‘pound-cost-averaging‘. This is what investors use to smooth out the ups and downs of the market. If you have £1200 to invest and invest it all in one go, you might get lucky and buy at a good time when the market is low and you will benefit more from any rises. Or you might get unlucky and as soon as you buy, the market might drop straight after and you could have bought much more shares for the same price a month later.

By pound-cost-averaging, you minimise these effects by investing £100 each month for the year and sometimes buying when the market is high and sometimes when it’s low – but it will average out.

For beginners like me, I found this a reassuring concept if you don’t want to spend hours reading about the market and trying to predict fluctuations.

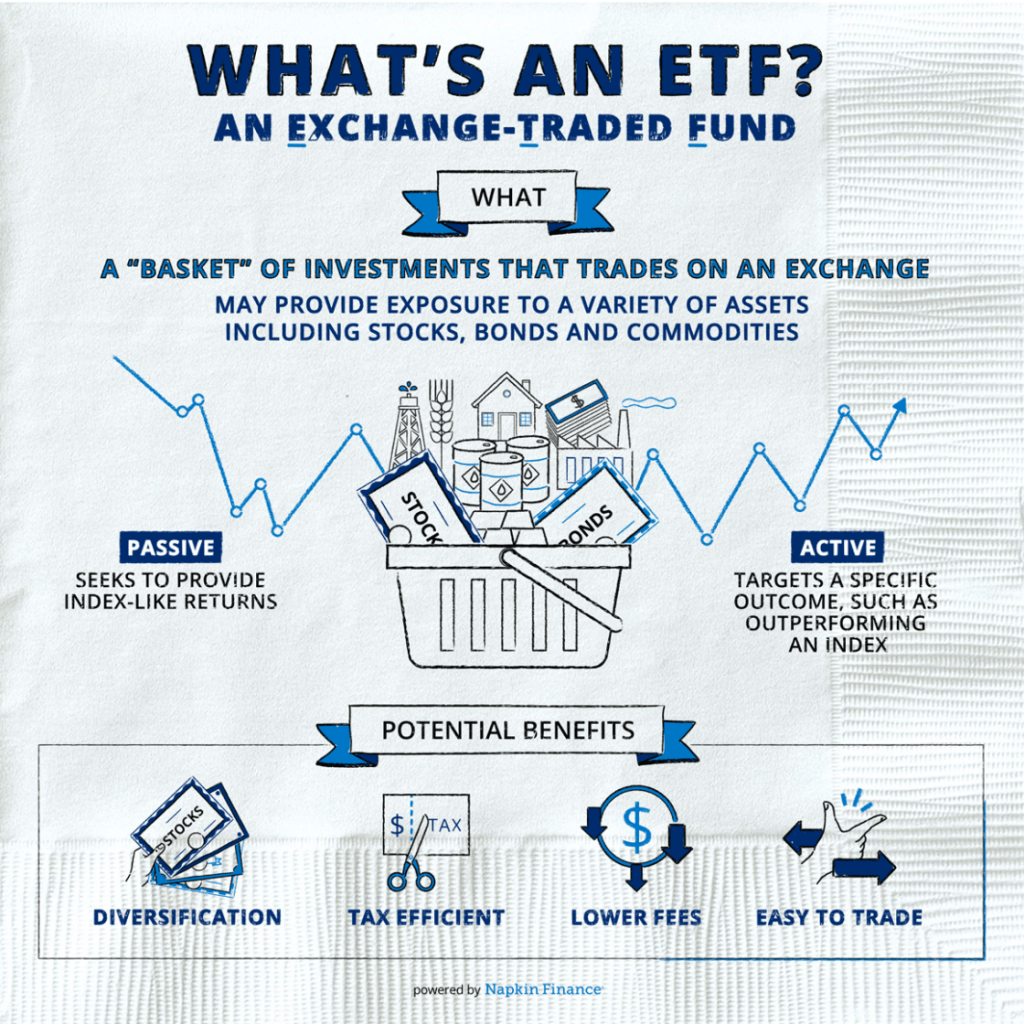

The last thing to navigate when starting out is – what on earth to buy? To make it ridiculously easy, I have invested in funds, specifically ETFs (Exchange Traded Funds). They are funds that track the market and are essentially made up of a huge range of stocks and bonds that are spread across the market. This reduces your risk by not ‘putting all your eggs one one basket’! Other options are index funds and mutual funds. Worth researching on your own but in essence, they are great investments for anyone but especially beginners. They track the market which overall throughout history has always grown.

Ok finally – how do I actually invest?

1. Start with picking an online trading platform or stockbroker! There are plenty out there that are all slightly different – make sure you know their trading costs, as well as reputation, and how easy you feel their website or app is to navigate. Examples of platforms are Hargreaves Lansdown, IG, AJ Bell, etoro… (not necessarily recommending any one over another – these are just some well known ones).

2. Next, open an account with them. I’d recommend opening a Stocks and Shares ISA as you can put upto £20,000 in one each year tax free. You could also go with a SIPP (self-invested personal pension) or Lifetime ISA (max input of £4,000 per tax year). You will have to provide bank details of the account you are planning to transfer money from into this account.

So you’re all set up!

3. You can now search for specific stocks you have in mind or funds that you want. I spent a little while browsing through different ETFs and mutual funds available, getting the hang of how much a good % return rate is and what sort of historical performance was good and bad. Of course, whatever has done well previously, has no guarantee of doing well in the future but you can be guided by it.

4. Deciding on risk is something that can seem scarier than it needs to be I think. Essentially it is down to personal preference but there are some guidelines you can use to help you work out your comfortable risk tolerance.

If you are looking to invest long-term (i.e. 20-40 years), you can get away with a lot higher risk because although short-term your money might fluctuate more than a lower risk, long-term the market has always grown historically, so you can get potentially higher investment returns on a higher risk category without worrying about short term ups and downs.

If you are looking to invest more short term (i.e. 5 years), a lower risk means you have a better chance of your money being safer as it will be at less risk dropping significantly with short-term market fluctuations.

5. Once you have picked a fund you like the look of, transfer over the amount of money you want to invest into the stocks and shares ISA. Select the fund and click ‘Buy’. When you are on the sale page, type in the amount of money you wish to invest at that time and follow the prompts – each trading platform will be different!

Et Voila! You have just invested for the first time! Easier than you think isn’t it?

Remember, you don’t need to know everything about the market to make your first investment. You just need some money and half an hour set aside to get going. Over time you will learn more and start to develop a plan and strategy. But most of all enjoy! Just buy, hold and sit back 🙂

Conclusion

There are plenty of other ways to invest, such as with a financial advisor, with your bank, or stock broker and there are benefits and disadvantages to each of these. The method described in this post is the way that I started, and I feel is the easiest for those who want to DIY invest with low costs!

** Disclaimer – this is information, not advice. Please consult a financial advisor for personal advice.

5 thoughts on “Step-By-Step Guide for Making Your First Investment”