In case you missed it, VetYou hosted the first of their 2022 webinar series last Tuesday. And what a great start!

The topic of conversation was ‘Investments from ISA’s to Savings’. The link to watch it back is here, but if you don’t have time, continue reading for the need-to-knows! The webinar was presented by Ruth Downs, a financial advisor who works specifically with veterinary professionals and therefore truly understands our needs, our (sometimes) lack of financial knowledge and side-steps all the jargon and gets to the nitty gritty of what you really need to know. The other great thing about Ruth is that she knows what it’s like to feel intimidated and confused by the financial industry and uses her experience prior to becoming a financial advisor to make her expertise as approachable as possible. She made clear from the very get-go – no question is a stupid question!

The great thing about getting this introduction to Ruth is that you don’t have to start navigating the bewildering world of finance trying to find an advisor you hope you can trust. Ruth is a trusted advisor by VetYou, so you know you can rest easy in her hands.

As VetYou want to make personal finance expertise as accessible as possible, Ruth is available for free scheduled online chats with no obligation to go further with any financial products she recommends. If you just want someone to explain the difference between all the ISA’s you can have, what you should do about your pension, or even just how to start budgeting – she’s there to listen, work with you and create a personalised plan for you as an individual.

Enough about Ruth! What do you need to know?

- So you want to start saving – where do you start?

The main point made here was: before you start shipping money out into a savings account, you need to know how much money you have incoming and outgoing. Sitting down with a cup of tea and working out your monthly budget is probably one of those things you’e been meaning to do for a while but never got round to – believe me I’m the same.

But, VetYou have cut out a lot of the work for you already. They have a budget questionnaire and spreadsheet ready to go that you just need to fill in – you can download this here.

Once you know how much you should have spare at the end of the month (whilst factoring in money for spending on fun stuff!) you can see how much you can put away into savings.

2. Before you get excited about making it big on the stock market…

Do you have an emergency fund? See my previous blog here with lots of info on emergency funds but Ruth really reiterated how important it is to build one up for unexpected expenses such as house repair, car breakdown, sudden loss of income etc.

She advised a minimum of having 3 months’ worth of necessary expenses in an accessible account. If you can go more, the more secure you’ll be in times of emergency!

3. Making choices when saving

First things to think about when you’re saving are: What are you saving for? What’s my timeframe? And how do I want to do it?

Having a goal in mind will help to create more of a direction and structure with your savings. This could be something like saving for a house or for a growing family. Indirectly your goal will likely apply a basic timeframe e.g. aiming for a house in the next 5 years.

The next thing to decide is if you are someone who wants to save in regular monthly or weekly intervals or prefers larger lump sum savings deposits. Not one way is a ‘correct’ way – it is totally personal! Again Ruth will be able to help you decide what works for you if you want to discuss it with her.

The final choice is a trickier one – what should you save into?

The choice of savings accounts can be overwhelming but there are a few you should be aware of that have huge tax benefits – ISAs. ISAs (Individual Savings Accounts), are savings accounts that you do not pay tax on. There are a few rules to be aware of but it’s not too complicated.

There are 4 types:

- Cash ISA

- Stocks and Shares ISA

- Innovative Finance ISA

- Lifetime ISA

Apart from the Lifetime ISA, you can put a maximum of £20,000 into an ISA in each tax year. This can be into just one type, or split between a few. For example, if you had a Cash ISA and a Stocks and Shares ISA, and you had £13,000 in the cash ISA already, you would only be able to put a maximum of £7,000 into the Stocks and Share’s ISA until the end of the tax year.

The Lifetime ISA is a bit different: here we go-

- It can be opened between the ages of 18 and 39 years old

- You can save up to £4,000 in it per tax year until you’re 50 years old for purchasing your first home or retirement.

- Alongside the zero tax benefit, you also get a 25% cash bonus of up to £1,000 a year from the government which is paid monthly if you’ve contributed that month.

4. Pension, pension, pension!

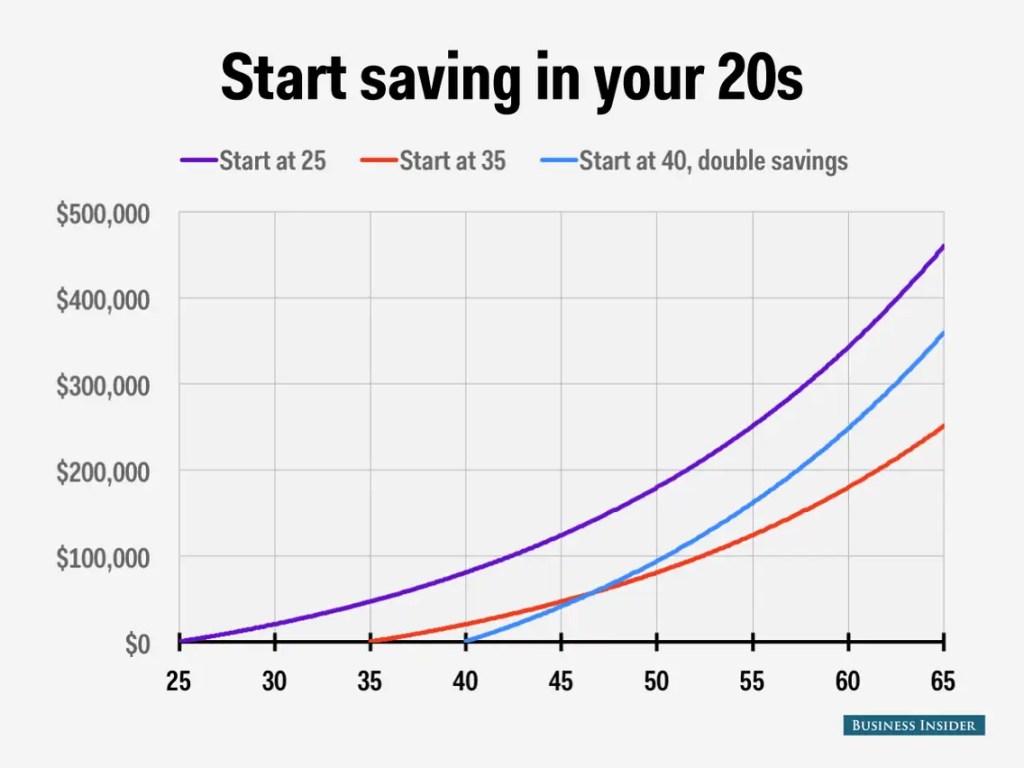

The sooner you start paying into a pension the better because of…. compound interest! See below courtesy of Business Insider:

Ruth went into detail about personal pensions vs workplace pensions and salary sacrificing. If you want more information, this is the link to last year’s pension webinar from VetYou – alternatively look out for the sign up for the VetYou online pension events in March and May this year!

Another useful resource is the pension finder on the government website to find old pension providers from previous jobs. There is approximately up to £400 million pounds in lost pensions and seeing as people now have on average 11 job roles in their working-life, you can have as many pension pots to track down!

Conclusion

These are the main takeaway points from this webinar. There are webinars scheduled for every month this year and they will delve into some of the above mentioned topics in more detail. These range from pensions to salary negotiation! I will definitely be checking them out, as not only do I love a free personal finance resource but they’re all tailored to us as veterinary professionals.

Not only do you get to access to the webinar when you register with the link provided, you also get a seriously cool online delegate goodie bag with links to heaps of resources. I’ve linked to some great ones that I enjoyed below:

Calculate your monthly take-home after NI, tax, pension etc:

Schedule a chat with Ruth Downs (VetYou trusted Financial Advisor):

And check out this video on salary negotiation:

Once again, thanks for reading! If you like this article, sharing it on socials and commenting would make a huge difference for me! See you again!

** Disclaimer – this is financial information that has been fact-checked by an independent financial advisor. This is not financial advice.