Often known as a F*** You Fund, emergency funds are vital to have in case of a – well- emergency!

Saving is one of the best ways to get on track with your finances and to gain personal financial control. If you start to save more and more each month, it can feel exciting having an amassing sum of money sitting in an account just waiting to be spent – why not treat yourself to that holiday? Or maybe a phone upgrade is in order?

But WAIT! Before your eyes begin feasting, do you have back-up money in case you have a sudden income loss or encounter a large unexpected expense? This can be for any number of reasons: you decide to quit suddenly and don’t have a job lined up, you’re let go from your current job, or even something as simple as your car breaks down and you need to spend a lot repairing it or buy a new one.

If you speak to any financial advisor, they will always recommend to have an emergency fund for scenarios such as these. This means you can live without worrying about how you’ll cope financially if anything comes up, as you can dip into your emergency fund instead of taking on debt or relying on family or friends.

So how much do you need to have?

This varies from person to person but most experts recommend having 4-6 months’ worth of your total living expenses saved up in an accessible savings account. This includes your mortgage/rent, utilities, food, phone, insurance etc. I found it useful to look back on my last few bank statements and work out exactly what my necessary monthly costs totalled to. When you have this figure, simply multiply that by 4, 5, or 6.

How to make a start?

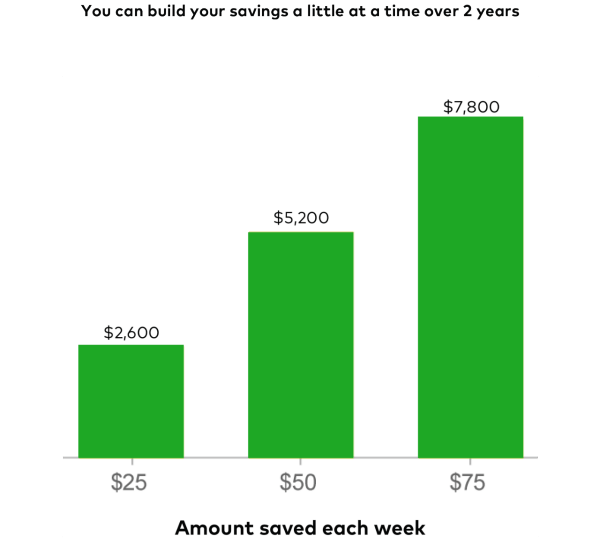

Having a large lump sum in your mind can feel intimidating and unattainable but starting small and building gradually is really effective and feels relatively pain-free!

1. Automating payments from your current account into a savings account every week means that money is being saved with zero effort or need for remembering. Starting with £10-£20 per week will not feel like a huge amount but that’s £40-£80 per month, and £120-240 after only 3 months of saving!

2. Get on-board with the pay yourself first rule. Instead of waiting for the end of the month and transferring whatever is left (if there is anything!) into your savings, be intentional with your savings and transfer over a planned amount on the day you get paid.

Not only does this mean ensuring you always make a monthly contribution, but it also puts you in the mindset of prioritising your own long-term wealth over short-term consumer needs.

3. Gradually increase over time when you can. Get a pay-rise? Increase your savings contributions. Receive a bonus? Increase your savings contribution. By gradually increasing how much you contribute, you’ll feel less of a hit in your current account and the amount in your savings will snowball!

If you’re as weird as me, you can really get a buzz from seeing more and more tucked away, and this is seriously motivating to save even more!

What now?

After you’ve saved 4 months’ worth, keep trying to increase to 5, then 6! If you’re totally happy with your sum. The next step (after you’ve also paid off any bad debts) is making any extra money you earn start working for you.

With the recent increases in inflation, your money sat in a low interest rate savings account with your bank will actually LOSE value over time – so how do you counteract that? Investing! More on that in a future blog post but if you’re interested right now, Female Invest do a great free monthly live webinar on ‘Introduction to Investing’ which helped me a lot!

As always please like, follow and comment if you’ve enjoyed this post!

Disclaimer: this is only financial information, not advice. Please seek advice from a Financial Advisor.

7 thoughts on “Everything You Need to Know About an Emergency Fund!”